Related material matters and sustainable development goals

Material matters:

1. Deliver on our core purpose

5. Leverage our capabilities to support resilient ecosystems

Sustainable Development Goals:

9. Industry, innovation and infrastructure

Deepening the social value of our products

Our core markets of South Africa and the United Kingdom have led the way in deepening social value. In South Africa, we are using our unique approach to healthcare insurance and wellness to provide products that protect and enhance the lives of people, helping to make healthcare accessible to a broader market and alleviating some of the burden on public healthcare systems. We are extending this approach in life assurance, short-term insurance, savings and investments, and banking.

Discovery Health’s strategic objective is to become the lowest cost administrator, with ongoing investment in technologies to optimise operational efficiency and service levels. This not only supports better business and member satisfaction, but lowers healthcare costs.

8.8 member satisfaction score (out of 10) in Discovery Health Medical Scheme

In Discovery Health Medical Scheme, members pay an average of 16.7% less than they would at the next ten largest open schemes

Discovery Health offers the broadest product range, with premiums lower than the cheapest competitor on a benefit-adjusted basis

The weighted average contribution increase for Discovery in 2020 was 9.5%

Efforts to reduce fraud and waste in the healthcare system increases value for members and supports efficiencies and trust in the healthcare system.

By strengthening and expanding access to quality private healthcare, Discovery Health reduces the burden on the public healthcare system.

Discovery KeyCare is an affordable medical aid option that is combined with KeyFit to give access to wellness facilities, incentives and tools to encourage healthier behaviour

Discovery Primary Care is a unique healthcare product that enables employers to provide employees and their families with affordable quality private healthcare and wellness management at a cost that is acceptable to employees at all income levels.

Discovery Health supports a number of interventions to improve the quality of care for its members by implementing and expanding value-based contracting initiatives with doctors and other service providers including:

DiabetesCare, CADCare and KidneyCare programmes, which ensure subscribed members get high quality coordinated healthcare and improved outcomes

Discovery HealthID shares important information with healthcare professionals selected by patients to give a more complete view of their health history and test results. This improves patient care and reduces the likelihood of serious medical errors and duplicate or unnecessary pathology tests. In addition, HealthID also reduces the administrative burden for doctors

Discovery’s Patient Satisfaction Survey rates the quality of care received by participating medical scheme members at hospitals and incentivises further improvement on the part of hospitals for the benefit of all patients, including Discovery members.

We drive a savings culture and reward good financial choices through Discovery Bank.

Discovery data shows that positive behavioural change is seen just two months after joining Discovery Bank

Credit arears rate 5.4 times less than the market*

R3.7 billion retail deposits (with average deposits being 5 times higher than the market).

* TransUnion statistics

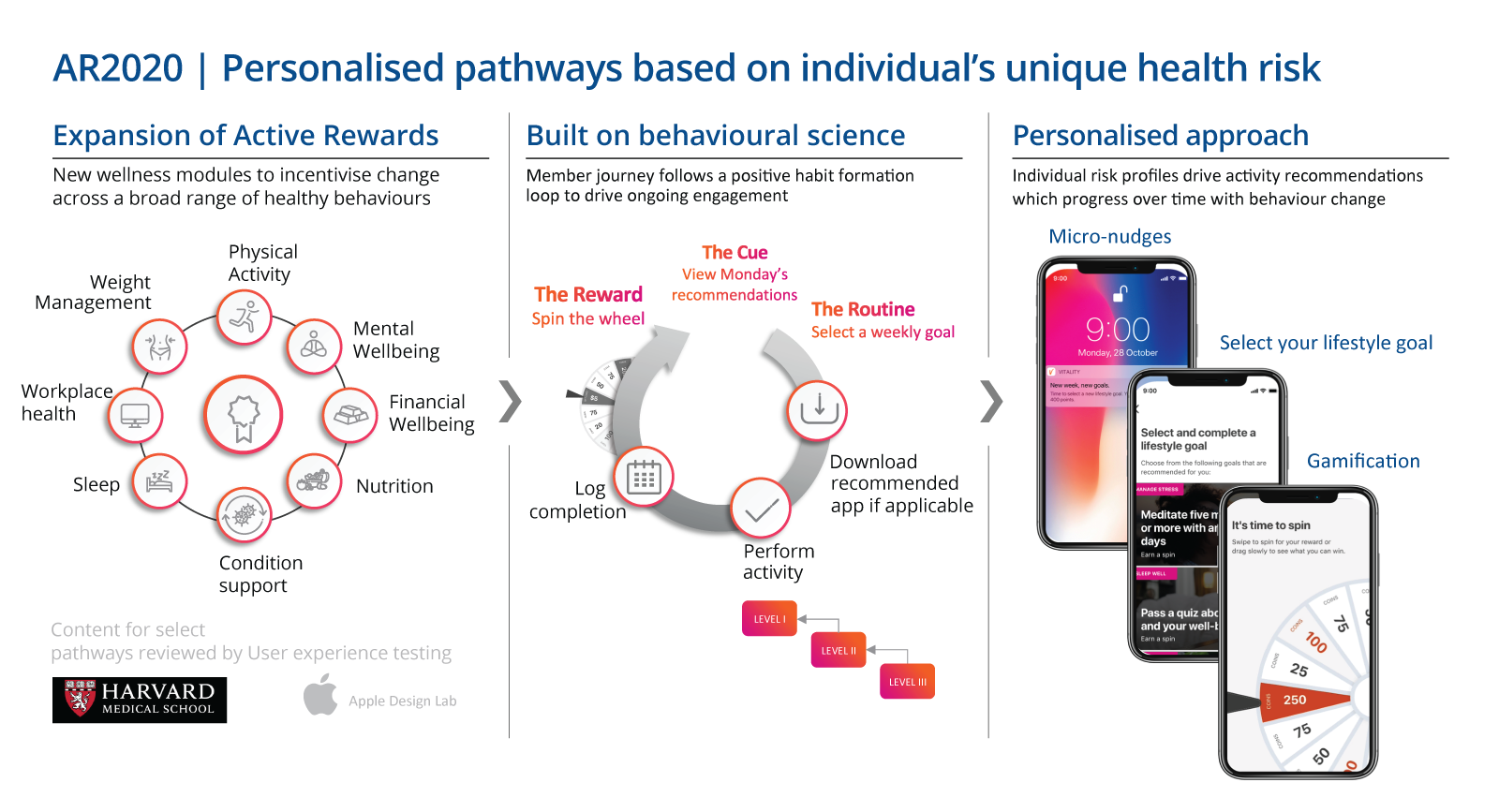

Our Vitality1 platform is a globally unified systems architecture that markets can access, allowing rapid and economical deployment to our partners. Through Vitality1, we are increasing the positive behavioural impacts of the Vitality programme globally by:

Enabling more frequent engagement between our insurer partners and their customers

Leveraging increasing quantities of data gathered from insurers across different countries to improve and develop new models

Providing our partners with access to increasingly accurate insights on what behaviours and incentives achieve the best outcomes and greater social impact.

Applying behavioural economics

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investments, banking, and wellness markets.

The Challenge:

4 lifestyle behaviours and 4 chronic conditions contribute to 60% of deaths worldwide

The Behaviours

- Poor diet

- Physical inactivity

- Tobacco use

- Excess alcohol intake

The Conditions

- Various cancers

- Chronic lung disease

- Diabetes

- Cardiovascular disease

Sources

World Health Organisation and its Global Burden of Disease assessment

Discovery’s response

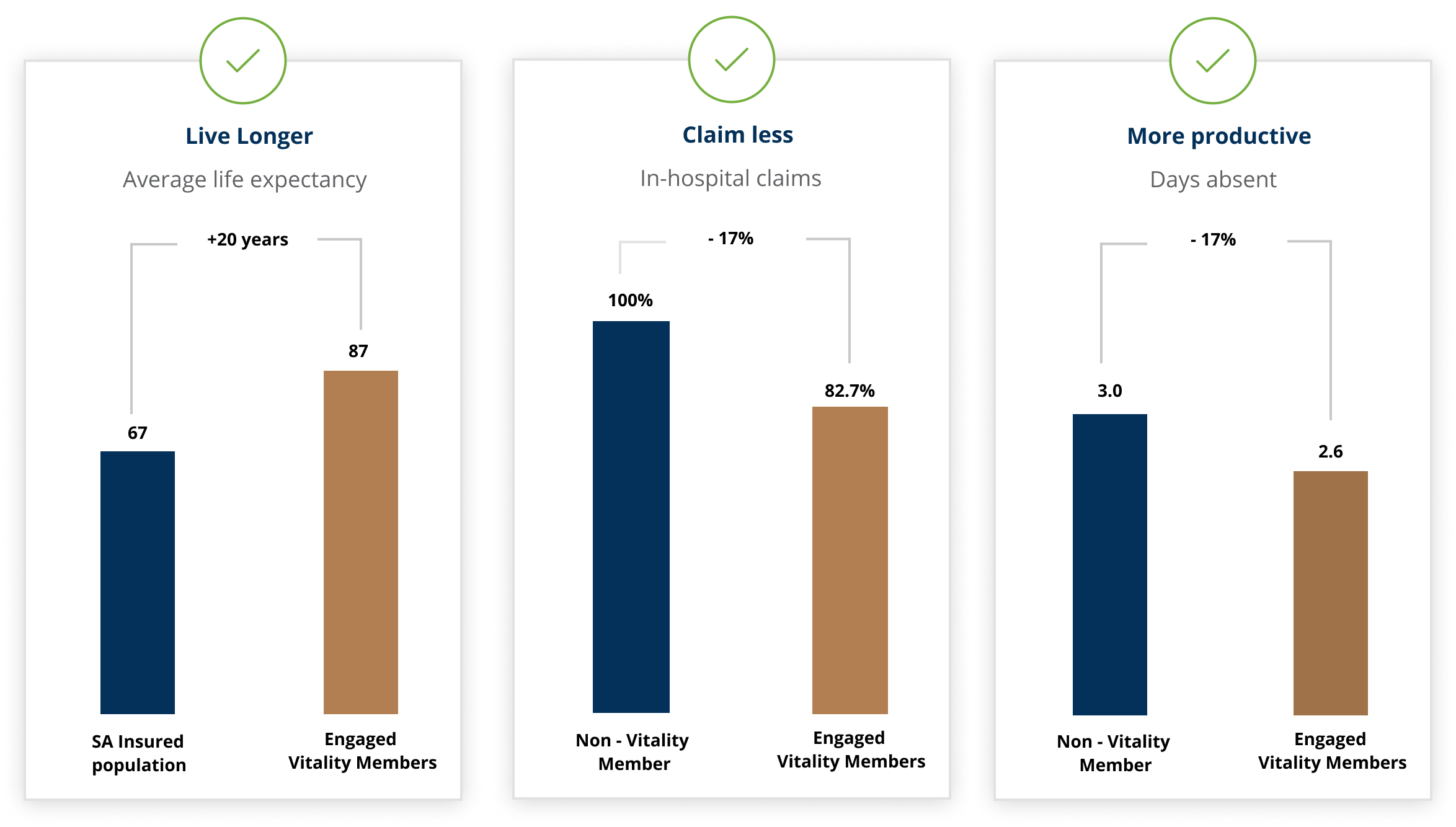

Make people healthier and live longer

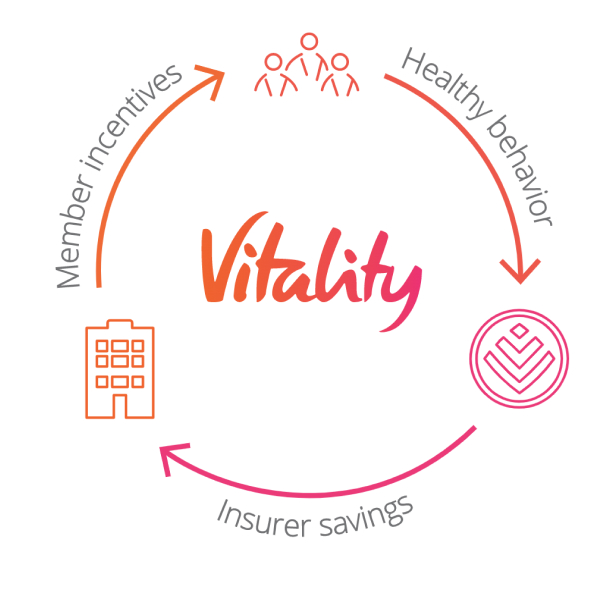

Activated through our Shared-value Insurance model

Along with our partners, we use the Vitality Shared-value Insurance model to change the way consumers worldwide experience insurance

How we respond

As a catalyst for behaviour change, we incentivise and reward our members to Improve their health by providing better value and improved price and benefits.

… which sustains our business through:

Healthy behaviours supporting:

- Lower claims

- More profitable and sustainable business

- Positive selection and lower lapses

… and has a positive impact on society as:

Savings and healthier behaviours support:

- A healthier society

- Improved productivity

- Reduced healthcare burden

… leading to a virtuous cycle of shared value.

The Challenge:

5 driving behaviours and 3 driving conditions account for 60% of fatal accidents

The Behaviours

- Excessive drinking

- Cellphone use while driving

- Excessive speeding

- Harsh braking

- Lack of vehicle care

The Conditions

- Distracted driving

- Loss of vehicle control

- Aggressive driving

Sources

Road Traffic Management Corporation and U.S. Department of Transportation

Discovery’s response

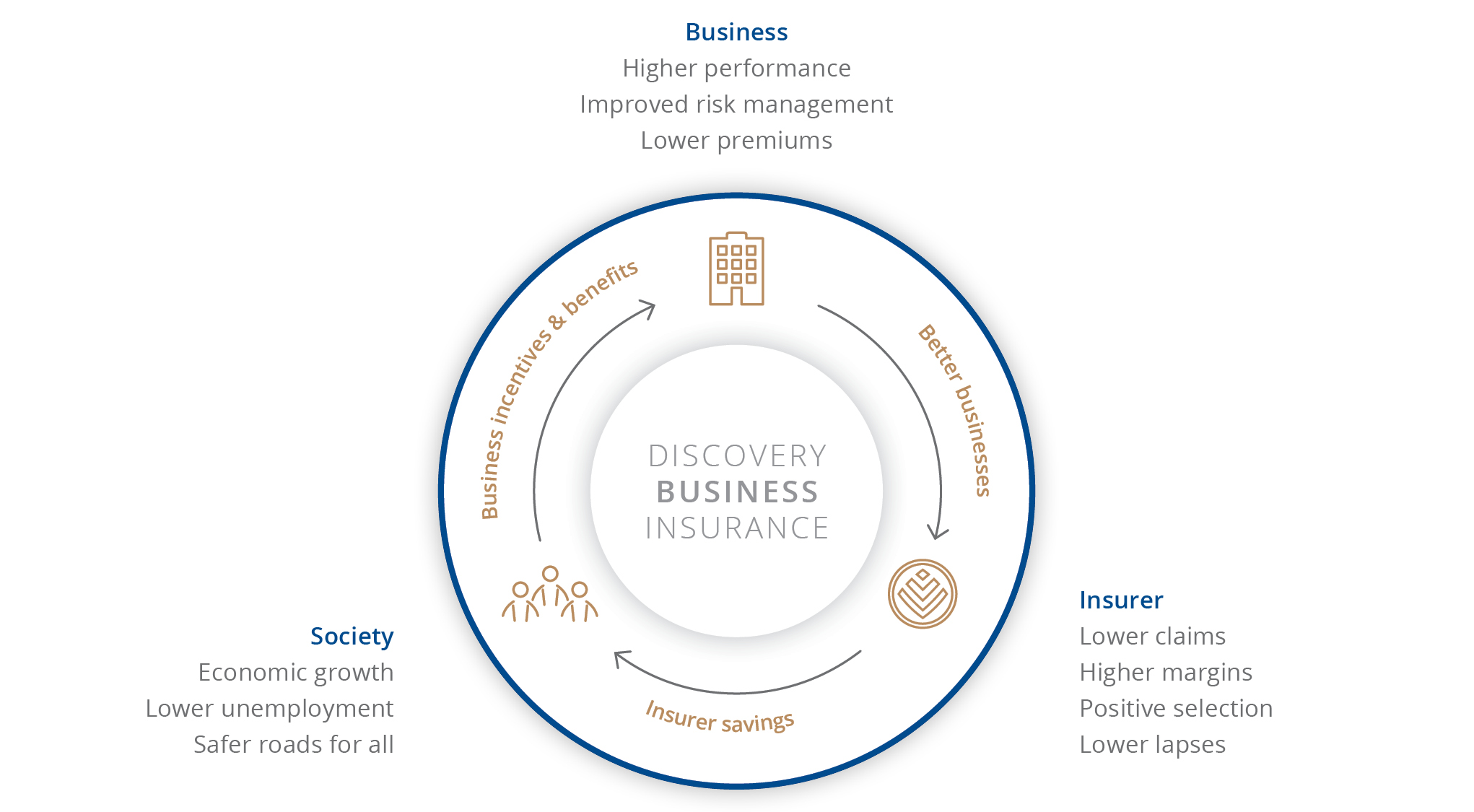

Make people better drivers and have fewer road accidents

Activated through our Shared-value Insurance model

Along with our partners, we use the Vitality Shared-value Insurance model to change the way consumers worldwide experience insurance

How we do this

As a catalyst for behaviour change, we incentivise and reward our members to improve their driving by providing better value and improved price and benefits.

Sustaining our business

This supports Discovery, our partners and networks through improved driving behaviours supporting:

- Less vehicle accidents

- Lower claims

- Higher margins

- Positive selection and lower lapses

Sustaining society

Savings and healthier behaviours have a positive societal impact through:

- Nation of better drivers

- Less road deaths and injuries

- Less Road Accident Fund claims

The Challenge:

3 investment behaviours and 3 conditions result in 90% of people having inadequate retirement funding

The Behaviours

- Insufficient contribution levels

- Inadequate investment terms

- Irresponsible withdrawals in retirement

The Conditions

- Insufficient retirement income

- Intergenerational debt

- Dependence on state resources

Sources

National Treasury

Discovery’s response

Make people better prepared for retirement

Activated through our Shared-value Insurance model

Along with our partners, we use the Vitality Shared-value Insurance model to change the way consumers worldwide experience insurance

How we do this

As a catalyst for behaviour change, we incentivise and reward our members to save for longer, practice responsible financial behaviour and a live a healthy lifestyle.

Sustaining our business

This supports Discovery, our partners and networks through better financial behaviours supporting:

- Longer investment

- Better persistency

- Lower withdrawals

Sustaining society

Savings and healthier behaviours have a positive societal impact through:

- Stronger savings culture

- Lower pension reliance on the state and family

- Better client outcomes

The Challenge:

5 controllable behaviours and 3 conditions lead to 80% of credit defaults and retirement shortfalls

The Behaviours

- Corrosive consumption

- Lack of financial protection

- Not saving for emergencies

- Excess secured debt

- Low retirement savings

The Conditions

- Unable to deal with unplanned expenses

- Unsustainable and expensive debt

- Not being protected in retirement

Sources

Journal of Economics and Finance and other sources

Discovery’s response

Make people manage their money better

Activated through our Shared-value Insurance model

Along with our partners, we use the Vitality Shared-value Insurance model to change the way consumers worldwide experience insurance

How we do this

As a catalyst for behaviour change, we incentivise and reward our members to achieve lower rates on borrowing, higher rates on saving, along with better financial management to generate greater wealth.

Sustaining our business

This supports Discovery, our partners and networks through improved financial behaviours supporting:

- Spending through the bank

- Lower defaults

- Reduced lapses

- Greater margins and profits

Sustaining society

Savings and healthier behaviours have a positive societal impact through:

- Reduced reliance on the state in retirement

- Greater national investment levels

- Reduced financial bad habits